Income Tax Calculator Tools and FAQ guide for tax e-filing Income Tax 101 with our easy to use calculator and tax guides. MTD as final tax Starting from Malaysia income tax Year of Assessment 2014 tax filed in 2015 taxpayers who have been subjected to MTD are not required to file income tax returns if such monthly tax deductions.

The Canadian average household net worth and the average provincial net worth are taken from the Median net worth data of Statistics Canada Survey of Financial Security 2012.

. 1 Pay income tax via FPX Services. As per the agreement income shall be deemed to arise as follows. Learn the Basics.

Calculator provides comparison between Old and New Tax regimes laws for FY 2022-23 useful to know income tax amount to be paid to provide IT declaration to your employer. Tax Relief For Resident Individual for Assessment Year 2020. Loans enable you to hold on to your cash in hand by charging you an interest over a certain period of time.

It should not be relied upon to calculate exact taxes payroll or other financial data. Important Note on Calculator. Malaysian personal tax relief 2021.

Here are the many ways you can pay for your personal income tax in Malaysia. On average the impact of sales tax on Americans is about 2 percent of their personal income. Car loan or financial service providers include banks and.

For example if a self earning entity generates a yearly income of Rs. Below is the list of tax relief items for resident individual for the assessment year 2020. However such deduction shall not exceed the Indian tax paid on the foreign income earned.

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips taxable scholarships or fellowship grants and unemployment compensation. Due to data limitations we do not have net worth averages for Northwest Territories Yukon and Nunavut. 1 crore then high tax liabilities accrues each quarter.

Get the most out of Malaysias banks and finance companies when you save invest insure buy and borrow. If an Indian Resident derives income and the same is taxed in the United States then India shall allow the amount equal to the income tax paid in the United States as a deduction. In Malaysia car loan tenures can take up to 5 7 or even 9 years.

Type the number into a text editor with no formatting and copy from there then you can paste the value into the calculator and the number will be autoformatted. The participating banks are as follows. The estimated value gets deducted from the Adjusted Basis Per IRS Publication 527 Residential Rental Property 2016 p6 Certain property cannot be depreciatedThis includes land and certain excepted.

This Calculator considers financial year age group such as Normal Senior Super Senior citizens residential status such as Resident or NRI Tax payer status such as Individual. The calculator only expects users to type numbers only and the calculator takes care of formatting the numbers with thousands separators. Make sure you keep all the receipts for the payments.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. There is a workaround. These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution.

First of all you need an Internet banking account with the FPX participating bank. It is best to make advance tax payment on actual income already released and net income projections. In tax terms the closing price is the basis Value of Land - Estimate the value of the land.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Therefore these monthly deductions are net of personal relief relief for spouse with no income child relief and zakat payments. Purchase Price - The closing price or contract price of the rental property.

Paying advance taxes on income projections may require complicated adjustments and revisions. Not ideal but it does. Sales tax provides nearly one-third of state government revenue and is second only to the income tax in terms of importance as a source of revenue.

The relief amount you file will be deducted from your income thus reducing your taxable income.

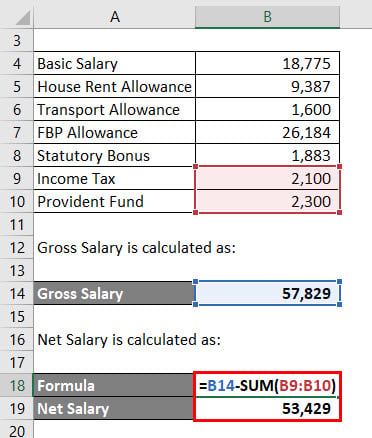

How To Calculate Income Tax In Excel

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Savings Rate 101 What It Is And How To Calculate It Savology

Equivalent Salary Calculator By City Neil Kakkar

Salary Formula Calculate Salary Calculator Excel Template

Remote Work Salary Calculator Airinc Workforce Globalization

Salary Formula Calculate Salary Calculator Excel Template

Every Forex Trader Should Know This Risk Reward And Win Rate Profitability Chart Forex Trading Quotes Stock Trading Strategies Intraday Trading

How To Calculate Mobile Advertising Revenue For App With 100 000 Users

Excel Formula Income Tax Bracket Calculation Exceljet

Salary Formula Calculate Salary Calculator Excel Template

China Salary Calculator 2021 Calculate Your Taxes And Income Tools Fdi China

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Taxable Income Formula Calculator Examples With Excel Template

Snigel Adsense Revenue Calculator Tool Google Data 2022

Market Share Formula Calculator Examples With Excel Template

How To Calculate Income Tax In Excel

- contoh borang transit

- era fm carta 40

- contoh surat jemputan majlis anugerah kecemerlangan

- ayat muka depan kad kahwin

- botol hdpe putih cover hijau

- corak bunga untuk border background putih

- fourtwnty hitam putih lirik chord

- cermin mata silau mahal

- taman malakun for sale

- undefined

- malaysia net income calculator

- tourist arrival in malaysia 2017

- pekerjaan di malaysia

- bukit merah development perak

- bahan bawang putih madu kolestrol

- harga kereta mercedes 2019

- majlis daerah machang

- taman didalam rumah kecil minimalis

- bacaan dalam solat berserta makna hitam putih

- hotel royal chulan seremban